unfiled tax returns for deceased

She had the mistaken belief that one did. Unfiled tax return for deceased mother.

What Happens To Unpaid Taxes After Death Community Tax

The deadline to file these returns is the normal filing deadline of April 30 th or six months after the date of death whichever is later.

. Request for Transcript of Tax Return to obtain tax records of the deceased person. On the final tax return the surviving spouse or representative will note. In 2021 the limit is.

Late Returns Unfiled Taxes James Abbott CPA from. If the estate is worth less than the limit estate taxes arent due but if its worth more the estate owes taxes and the executor or spouse is responsible for paying them. I have a client with unfiled tax returns for 2015 2016 2017 2018 and 2019 deceased in 2019.

While you may not be required to file a tax return for the deceased if the person made less than 12400 under 65 or 14050 over 65 its still a good idea to file because there. Deceased Persons and Unfiled Tax Returns. Claim the tax withheld on those payments on line 43700 of their Income Tax and Benefit Return.

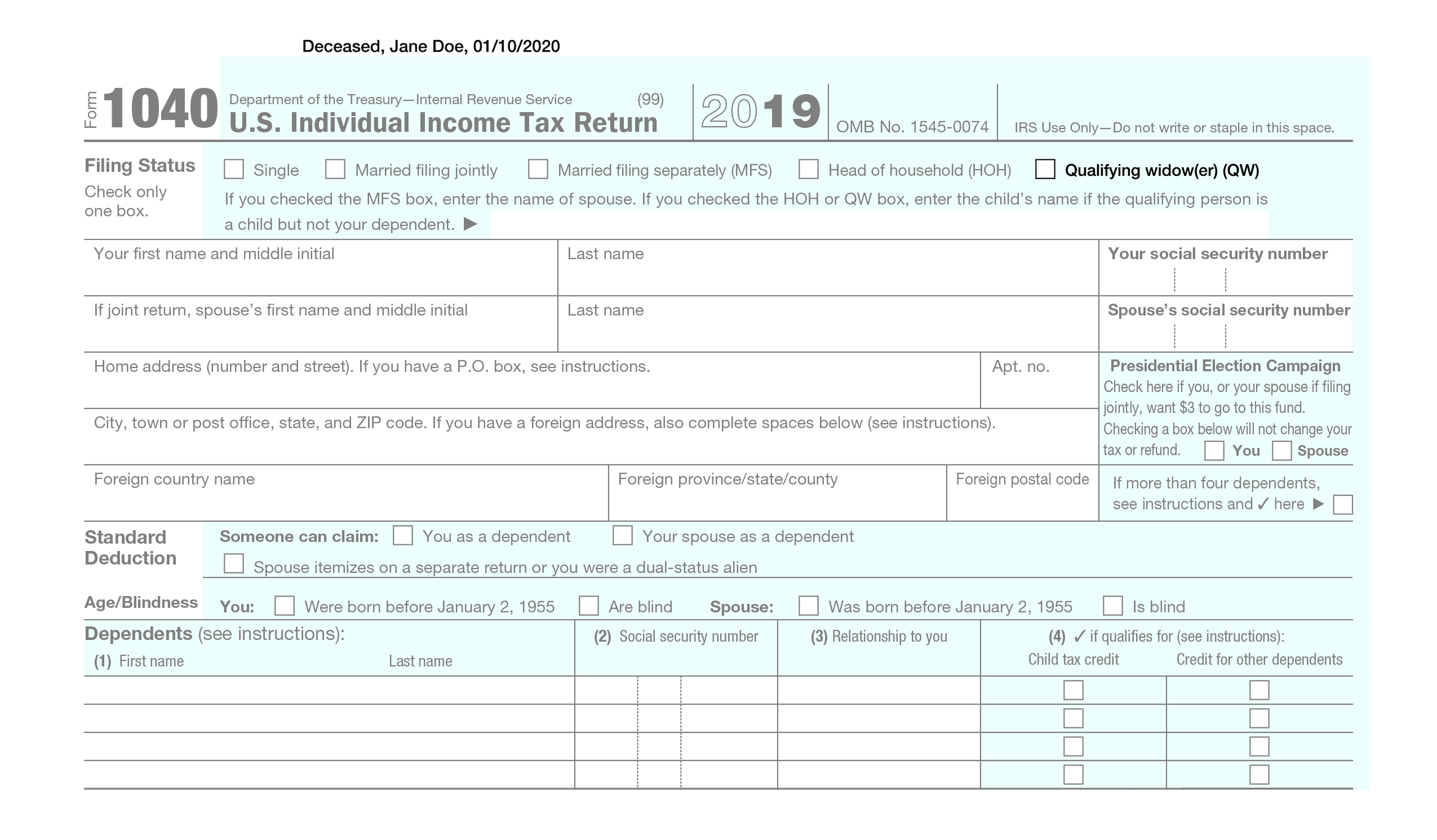

If the deceased leaves an estate or an inheritance to his family it can be seized to satisfy the outstanding tax liability. File the return using Form 1040 US. Federal Tax Liens.

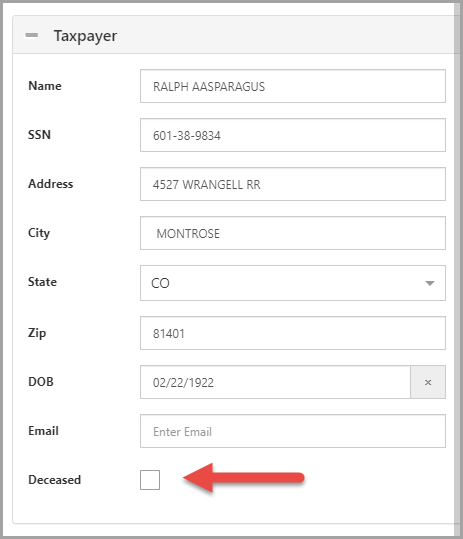

Typically the administrator will file Form 1040 and he or she may also be required to file tax returns for any previous years in which the deceased person failed to file a return. When you notify us of the death we can tell you if the person had any outstanding tax returns for prior income years. Because of the sensitivity of this topic it might seem a bit.

If there are outstanding tax returns these will also need to be lodged. Final tax returns must be filed for deceased persons as well. File the Final Income Tax Returns of a Deceased Person File a Current Tax Year Return.

The answer is unfortunately yes. Individual Tax Return or 1040-SR US. When a person dies the tax deadline is automatically extended to April 15 tax day of the following.

If you die with a certain dollar amount of assets currently estates under. First are you the person that should be filing for them. Whether the decedent is required to file a tax return if unsure go to the topic.

The tool is designed for taxpayers who were US. Filing taxes on a deceased individual has its own set of concerns. Report income earned after the date of death on a.

On the final return report all of the deceaseds income from January 1 of the year of death up to and including the date of death. After my mothers recent death it was discovered she had not filed a personal income tax return for 10 years. Form 1040 W-2s for withheld income and 1099s.

Unfiled tax return for deceased mother After my mothers recent death it was discovered she had not filed a personal income tax return for 10 years. Write deceased next to the taxpayers name when filling out tax forms. If the deceased leaves an estate or an inheritance to his family it can be seized to satisfy the outstanding tax liability.

Do I Need to File a Tax Return. If the deceased was self-employed they may have received federal provincial or territorial. She had the mistaken belief that one.

When someone dies their surviving spouse or representative files the deceased persons final tax return. If you dont file taxes for the decedent and the estate promptly the IRS can file a federal tax lien requiring you pay the decedents income tax ahead of other. Late Returns Unfiled Taxes James Abbott CPA from.

A deceased person needs one last tax return filed in their name especially if they were a regular filer. The federal estate tax sometimes called the death tax is a one-time tax that is imposed at death. You may need to file IRS Form 4506-T.

Can I efile any of these returns - I recall seeing.

What Happens If A Deceased Person Owes Taxes Tax Group Center

How To File Taxes For A Deceased Relative Experian

Blog Archives Page 2 Of 35 My Irsteam

The Tax Consequences Of Death Hopler Wilms Hanna

Who Contacts The Irs When Someone Dies

How To File Federal Income Tax For A Deceased Person Help When Someone Dies Tusk

Blog Archives Page 2 Of 35 My Irsteam

Tax Definitions Tax Glossary I Tax Defense Network

Learn About Filing Taxes For Deceased Spouse H R Block

Tax Return Signature For Deceased Persons Simplified Instructions Tax Resolution Professionals A Nationwide Tax Law Firm 888 515 4829

News And Announcements Demian And Company Cpa

Why Did I Receive An Irs Cp14 Notice In The Mail Your Guide What To Do With The Irs Cp14 Letter Get Rid Of Tax Problems Stop Irs Collections

Owe Back Taxes Pa Amnesty Ends June 19

Irs Notices And Letters Where S My Refund Tax News Information

How To Complete The Fafsa When Parent Didn T File Tax Return Fastweb

Tax Help Irs Form 56 Irs Tax Advocate

Income General Information Department Of Taxation